Administration of NEH Challenge Infrastructure and Capacity Building Grants(for awards with prefix CHA issued on or after February 1, 2022)

Published January 20, 2022 (Updated on January 30, 2025, to reflect changes to the dollar threshold for submitting individual donor documentation with the gift certification to NEH.)

For NEH Challenge Grants offers and awards issued on or after February 1, 2022, with a federal award identification number prefix “CHA"

Download a PDF of the Administration of Challenge Infrastructure and Capacity Building Grants (for awards with the prefix CHA issued on or after February 1, 2022)

TABLE OF CONTENTS

- Applicability and Authorities

- Offers and Awards

- Match and Release of Federal Funds

- Award Conditions

- Eligible Matching Gifts

- Restricted and Unrestricted Gifts

- Types of Gifts

- Cash

- Non-federal grants

- Special legislated non-federal appropriations from state, county, or municipal governments

- Net proceeds from special fundraising events or benefits held specifically to raise matching funds for an NEH Challenge Grant

- Contribution margin of membership contributions, "friends" or alumni giving, or similar campaigns

- Earned income, such as income from publication or gift shop sales

- Marketable securities, valued as of the date of transfer from donor to award recipient

- Real estate

- In-kind gifts or donated services

- Other Planned Gifts

- Pledges

- Use of Challenge Grant Funds as match for other non-federal grants

- Ineligible Gifts

- Certification of Third-Party Non-federal Gifts

- Failure to Meet the Annual Required Third-Party Non-Federal Gift

- Challenge Grant Management and Record Keeping

- Acknowledgment of support and disclaimer

- Requesting Payment of Challenge Grant Funds

- General Reporting Requirements

Appendix 1 - Sample Donor Letters

Appendix 2 - Federal Interest in Real Property

I. Applicability and Authorities

This guidance is applicable to Administration of NEH Challenge Infrastructure and Capacity Building Grants (for awards with prefix HA issued on or after February 1, 2022).

NEH awards are subject to the National Foundation on the Arts and the Humanities Act of 1965 (P.L. 89-209, as amended; 20 USC § 956 et seq.); 2 CFR Part 200 – Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards; the General Terms and Conditions for Awards to Organizations (for grants and cooperative agreements issued January 1, 2022, or later) (GTAC); and the specific terms and conditions in the offer letter and notice of action. Note, NEH’s GTAC is updated annually. The GTAC applicable to a specific Challenge Grant award is the one in effect at the time of issuance of a Challenge Grant award.

Should there be an inconsistency between the Administration of NEH Instructure and Capacity Building Challenge Grants the Notice of Funding Opportunity (NOFO) under which the offer was made, the latter will govern. Should there be any inconsistency between the GTAC and the specific terms and conditions of the offer letter and notice of action, the latter will govern. Should there be any inconsistency between the GTAC and the Administration of NEH Infrastructure and Capacity Building Challenge Grants 2022, or later, the latter will govern.

II. Offers and Awards

NEH issues offer letters to organizations whose applications are approved for funding. An offer is not an award or a guarantee of an award. An offer formally communicates the level of funding recommended for the project and the conditions that must be met. For NEH to issue a notice of action obligating federal matching funds for a Challenge Grant award, the organization must raise and certify eligible third-party non-federal gifts and meet all conditions of the offer letter.

Once an award is made, all federal matching funds and third-party non-federal gifts Challenge Grant funds must be expended during the period of performance on allowable project activities.

In accepting an offer or an award, the organization assumes the legal responsibility of administering the award in accordance with these requirements and maintaining documentation, which is subject to audit, of all actions and expenditures affecting the award.

Note, Challenge Grant terms and conditions apply not only to the recipient, but also flow down to any subawards as well as to subrecipients unless specified otherwise in regulation or the terms and conditions of the specific NEH award.

NEH’s recipients must use eGMS Reach, NEH’s online grant management system to communicate with NEH staff, submit reports and other award information.

A Note on Terminology

An organization that applies for a Challenge Grant is an “Applicant” until they are selected by NEH to receive an offer, at which time the Applicant becomes an “Offeree”. When NEH issues a notice of action obligating Challenge Grant award funds, the Offeree becomes a Recipient. For the purpose of this document, the term Recipient is used throughout, regardless of the organizations’ status.

Refer to Article III. of the GTAC for a full explanation of NEH and recipient roles and responsibilities.

III. Match and Release of Federal Funds

A. Match Ratio and Gifts and Matching Schedule

NEH’s Challenge Grant recipients are required to raise and certify gifts in order to receive NEH federal matching funds. Specific categories of match ratios are identified in the NOFO for which an application was submitted.

The gifts and matching schedule identifies the required third-party non-federal gifts that must be raised by July 31 to receive the full amount of federal matching funds for that year. Each Challenge Grant project has a unique match and release schedule based on the total project costs, match ratio, fundraising capacity, and the period of performance.

The project match ratio and a Gifts and Matching Funding Schedule for individual Challenge Grants are identified in the offer letter and award information in eGMS Reach.

The following chart illustrates a typical gifts and matching funding schedule for raising non-federal gifts and the release of NEH matching grant funds.

Sample gifts and matching funding schedule

NEH Challenge Grant offer of $300,000, with a 3:1 match ratio and a 4-year period of performance

Year 1

Year 2

Year 3

Year 4

Total

NEH -federal matching funds -

$25,000

$100,000

$100,000

$75,000

$300,000

Non-federal third-party gifts

$75,000

$300,000

$300,000

$225,000

$900,000

Total challenge funds (federal + non-federal)

$100,000

$400,000

$400,000

$300,000

$1,200,000

Challenge Grant recipients may certify eligible gifts ahead of the Gifts and Matching Funding Schedule. Should additional federal matching funds become available, NEH may be able to release funds ahead of schedule. Conversely, failure to raise and certify sufficient gifts to meet the annual federal matching offer amount may result in the forfeiture of the remaining balance of federal matching funds for that year (see Article VII.B. of this document for additional information).

B. Fundraising Period and Period of Performance

The fundraising period is five months prior to the NOFO application deadline through the end date of the period of performance. The period of performance is the start date and end date of the Challenge Grant award in which allowable award activities will occur and related costs are incurred. The period of performance is identified in the offer letter and notice of action.

All gifts (including pledged gifts), restricted and unrestricted, must be received during the approved fundraising period. All federal and non-federal Challenge Grant funds must be expended for costs incurred during the award period of performance.

IV. Award Conditions

The Challenge Grant offer letter references conditions in 2 CFR Part 200 Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards, the GTAC, that must be met during the performance of the Challenge Grant project. The offer letter also identifies specific conditions that must be met, before NEH will make an award

All NEH-funded projects involving construction, renovation, repair, rehabilitation, or ground or visual disturbances must comply with all applicable federal laws including those addressing wage rates, disability rights, historic preservation and environmental policy. In addition, recipients cannot start any physical work (demolition, construction, or renovation) on the Challenge Grant supported project (regardless of the source of funds), until NEH concludes its reviews and provides written notification of compliance with the offer letter conditions that must be met prior to making an award to the recipient. Failure to abide by these requirements may result in NEH withdrawing an offer. The recipient may use matching funds for approved non-construction preparatory activities, such as architectural and engineering designs, permitting, and licenses, and may also undertake work related to the environmental and historic preservation reviews prior to NEH completing its review.

Recipients should pay particular attention to national policy requirements specific to construction, renovation, and ground-disturbance:

- Build America, Buy America Act (Pub. L. 117-58 § 70901, et seq.)

- Davis-Bacon Act, as amended (40 U.S.C. §3141, et seq.).

- Executive Order 11246, Equal Employment Opportunity

- The Architectural Barriers Act of 1968 (42 U.S.C. § 4151, et seq.)

- Titles II and III of the Americans with Disabilities Act (ADA; P.L. 101-336, as amended by P.L. 110–325), which includes enforceable accessibility standards, called the 2010 Standards for Accessible Design (2010 Standards)

- Section 106 of the National Historic Preservation Act of 1966 (54 U.S.C. §300101, et seq.), and its implementing regulations,36 CFR Part 800. Section 106 requires NEH to consider the effects of projects offered or awarded NEH funding on historic properties and, when applicable, to provide the Advisory Council on Historic Preservation an opportunity to comment on such projects.

- Section 106 and NEPA guidance.

- National Environmental Policy Act of 1969 (NEPA, 42 U.S.C. § 4321, et seq.), and its implementing regulations at 40 CFR Part 1500

- Native American Graves Protection and Repatriation Act of 1990 (25 U.S.C.§3001, et seq., and 43 CFR Part 10)

- National Flood Insurance Act of 1968andFlood Disaster Protection Act of 1973 (42 U.S.C. §4001, et seq.)

- Executive Order 11988, Floodplain Management

- Executive Order 11990, Protection of Wetlands

- Executive Order 12898, Environmental Justice in Minority Populations and Low Income Populations

- Coastal Barriers Resource Act (16 U.S.C. §3501, et seq.)

- Wild and Scenic Rivers Act of 1968 (16 U.S.C. §1271, et seq.)

- Safe Drinking Water Act (42 U.S.C. §300f, et seq.)

- Clean Air Act (42 U.S.C. §7401, et seq.)

- Clean Water Act (33 U.S.C. §1251, et seq.), as implemented by Executive Order 11738, Providing for administration of the Clean Air Act and the Federal Water Pollution Control Act with respect to federal contracts, grants, or loans”)

The full text of applicable national policy requirements, and links to supporting guidance is in Article IV.S of the GTAC.

Recipients must also comply with the procurement standards at 2 CFR 200. § 200.317 - § 200.327 and the Appendix II Contract Provisions for non-federal entities under federal awards. These sections of of 2 CFR Part 200 contains information for contract types, when competition is required and contract provisions.

V. Eligible Matching Gifts

A. Restricted and Unrestricted Gifts

There are two primary categories of third-party matching gifts: restricted and unrestricted.

- Restricted gifts

Restricted gifts are restricted by the donor for the same purposes supported by the Challenge Grant. Donors of restricted gifts must state or be aware that their gifts are to be used for the Challenge Grant or the purpose supported by the Challenge Grant.

Proof of donor awareness can be in the form of individual transmittal letters from the donor. Recipients must submit individual donor letters or evidence of donor intent for restricted gifts of $25,000 or more (reference Appendix 1 for a sample letter) with the Certification of Matching Gifts for NEH Challenge Grants (Certification) form. Supporting documentation for other kinds of gifts must be submitted with the gift certification.

Other evidence of donor intent can be in the form of membership or alumni solicitation mailings; newsletters; public notices regarding contributions, admission fees, posters or other publicity for fundraising events; scripts for telethons or for radio or television solicitations; that can verify the donor's understanding that the gift will be used for the Challenge Grant, or the purpose supported by the Challenge Grant.

Note, a letter of receipt from the recipient organization is not evidence that the donor was aware at the time of donation that their gift is to be used for the Challenge Grant or the purpose supported by the Challenge Grant.

- Unrestricted gifts

Unrestricted gifts are not designated by the donor for any specific purpose. Funds previously designated for any specific purpose may not be changed to unrestricted funds by the recipient. Deposit of a gift into an unrestricted gift fund or a general operating fund is not considered to be “designated to a specific purpose.”

Recipients must document the nature of any fund that, contains gifts that are unrestricted. For any gift over $25,000, recipients must submit documentation as to the date the unrestricted gift was given with certification.

- Limitation on unrestricted, real estate, in-kind, and earned income gifts.

The combined total of certified unrestricted gifts, real estate, in-kind gifts, and earned income gifts may not exceed the total federal matching portion of the Challenge Grant.

- Limitations on using third-party non-federal gifts.

Gifts must be used to support the purposes outlined in the approved Challenge Grant application and are subject to the same requirements as the federal matching funds. Third-party non-federal gifts used for Challenge Grants may not be used for matching or cost sharing on any other Federal award (2 CFR § 200.306 (b)(2)).

B. Types of Gifts

Eligible types of third-party non-federal gifts must be in the form of cash, pledges, in-kind services, or real estate received from third parties during the fundraising period. Certain types of non-cash third-party non-federal gifts (real estate and in-kind services) may be allowable under limited circumstances and with prior approval from NEH

The following are the principal kinds of gifts that may be eligible as matching donations, along with additional supporting documentation, if required. When documentation or information is unspecified, the requirements in Article V.A.1. and 2. of this document apply:

- Cash

Cash is eligible as restricted or unrestricted third-party non-federal gifts.

- Non-federal grants

Non-federal grants may be eligible as restricted or unrestricted third-party non-federal gifts during the fundraising period. Note, the non-federal grant funds used toward third-party non-federal gifts must be received and expended within the Challenge Grant period of performance. A copy of the grant award along with its purpose with the legislation reference number, must be submitted with the certification.

- Special legislated non-federal appropriations from state, county, or municipal governments

Legislated non-federal appropriations may be eligible only as restricted third-party non-federal gifts. The appropriation must represent a level of support above the normal appropriation for the recipient organization. The legislative or budgetary language must make explicit reference to the NEH Challenge Grant, or to the purpose supported by the Challenge Grant and passed by the appropriate legislative body during the fundraising period. A copy of the legislative or budgetary language with the legislative legal citation, must be submitted with the certification.

- Net proceeds from special fundraising events or benefits held specifically to raise matching funds for an NEH Challenge Grant

Only the net proceeds raised during the Challenge Grant fundraising period may be eligible as restricted third-party non-federal gifts. The intrinsic value of the items donated for auction or sale is not eligible.

- Contribution margin of membership contributions, "friends" or alumni giving, or similar campaigns

Fundraising campaign contribution margins may be eligible only as restricted third-party non-federal gifts. The value of any tangible items received by donors, such as magazines, newsletters, or gift "premiums," must be deducted from a membership contribution to assess the actual gift value.

- Earned income, such as income from publication or gift shop sales

Earned income maybe eligible only as restricted third-party non-federal gifts. Such sales must be clearly identified to customers as contributing to the NEH Challenge Grant or to the purpose supported by the Challenge Grant. Only the net income from earned income may count toward the Challenge Grant.

- Marketable securities, valued as of the date of transfer from donor to award recipient

The value of marketable securities may be allowable as restricted or unrestricted third-party non-federal gifts only after the donated securities are sold or converted into cash.

- Real estate

Real estate that is integral to the Challenge Grant (i.e., if within the project scope), may be eligible as third-party non-federal gifts. The donation requires a signed and dated copy of the donor's gift transmittal letter indicating the date of the gift, evidence that the property is integral to the purpose supported by the Challenge Grant, and the estimate of the fair market value (see 2 CFR § 200.306(d)(2)) to submitted with the certification.

If the property is not directly integral to the humanities activities supported by the Challenge Grant, then it must be converted by the recipient into cash by means of sale and may be donated as a restricted or unrestricted gift. The value of the cash gift is the net sale price when the sale is completed. A copy of the signed and dated copy of the donor's gift transmittal letter indicating the date of the gift and that the property is to be liquidated to achieve the donation, and a copy of the bill of sale indicating the net sale value. must be submitted with the certification.

Real estate must be approved in advance by NEH.

- In-kind gifts or donated services

A material or service provided by a third party is only eligible as restricted third-party non-federal gifts. Such in-kind gifts and donated services must be for allowable activities and costs under the Challenge Grant. For example, if a vendor donates services or equipment for HVAC installation as part of a Challenge Grant project, these may be counted as an in-kind donation. Such services and materials must be valued based on the fair market for similar services and documented in accordance with 2 CFR § 200.306.

In addition to the donor letter, a description of the materials, or services provided and their fair-market value, must be submitted with the certification. Reference 2 CFR §§ 200.306 and .434 for additional guidance.

In-kind gifts and donated services must be approved in advance by NEH.

- Other Planned Gifts

To qualify as a gift eligible as a third-party non-federal gift an instrument of planned giving must meet the following conditions:

- The value of the gift must be determinable and unchangeable.

- The gift must be irrevocable.

Other planned gifts must be approved in advance by NEH. Types of planned gifts include:

Charitable Gift Annuity

A Charitable Gift Annuity (CGA) may be eligible as a restricted third-party non-federal gift. A CGA is a contract between the donor and an organization by which the donor contributes a sizeable gift, and the organization agrees to pay the donor at an agreed upon rate for each year until the donor's death. The Internal Revenue Service recognizes a portion of the annuity payment as a charitable gift. Only the gift portion of the annuity received during the Challenge Grant fundraising period may be eligible for matching.

A copy of the annuity and a copy of the letter from the organization indicating the allowable tax deduction (including the calculations by which the tax deduction was determined) must accompany the certification. If the annuity is intended as a restricted gift, a copy of the donor transmittal letter must be submitted with certification.

Estate Bequests

An estate bequest may be eligible as a restricted or unrestricted third-party non-federal gift. A bequest in a will is an eligible gift only if it is realized (that is, the donor has died), and the estate pays the bequest to the grant recipient within the fundraising period.

To qualify as a restricted gift, the will must refer to the challenge grant or to purpose supported by the Challenge Grant. A copy of the portion of the will containing the bequest intention must be submitted with the certification.

Gift from an estate

A gift from an estate may be eligible as a restricted third-party non-federal gift. An estate may have the authority to designate a cash gift for the Challenge Grant. To qualify as a restricted gift a copy of the portion of the will establishing authority for estate-determined gifts must be submitted with the certification.

Foundation grants and gifts

Different types of foundations are treated differently regarding the eligibility of their grants or gifts for matching. Documentation of the foundation’s permission to use their funds as a Challenge Grant matching gift with the certification.

Public or private foundations.

Grants from third-party foundations may be eligible as a restricted or unrestricted third-party non-federal gift.

Family foundations or funds.

Gifts from a third-party foundation or fund established and managed by a single family for the purpose of making charitable contributions to non-profit entities may be eligible as a restricted or unrestricted third-party non-federal gift.

Third-party foundation gifts made to a recipient’s institution-specific foundation.

Third-party non-federal gifts foundation gifts may be eligible as a restricted or unrestricted third-party gift. Such gifts that otherwise meet all eligible gift criteria, except that they are made to the recipient’s institution-specific foundation may be eligible for matching. Note, the recipient’s institution-specific foundation may not use its own funds to make donations to its own institution's Challenge Grant (see Ineligible Gifts).

Examples:

A foundation donates $100,000 that it can identify as coming originally from Donor Z, who gave the funds to the foundation within the fundraising period. If Donor Z signs a letter to the foundation stating that her gift may be used for the Challenge Grant, this $100,000 may count as a restricted gift. If Donor Z does not sign such a letter, the $100,000 is still eligible, but only as an unrestricted gift.

University X has a Challenge Grant to construct a computer center for the humanities. The University X Foundation gives $400,000 from its own assets, which are normally used to support various special projects at the university, in response to the Challenge Grant. This donation cannot count toward match: the foundation is not a disinterested third party.

Community foundations

Gifts from a community foundation may be eligible only as a restricted third-party non-federal gift. Foundations established to solicit and manage donations to various charities within a given community may give in response to a Challenge Grant and have their gifts count toward match.

Donor-advised funds

Donor-advised funds may be eligible only as a restricted third-party non-federal gift. Donor advised funds A charitable entity such as a community foundation or a commercial donor advised fund may be an eligible restricted gifts as third-party non-federal gift. While the gift legally becomes an asset of the receiving foundation when the donor advises the foundation to use the funds for Challenge Grant purposes, the gift is treated as emanating from the original donor-advisor (the individual). Documentation from the donor-advisor must be provided to NEH with certification.

- Pledges

Pledges may be eligible only as restricted third-party non-federal gifts. Pledges must be made during the fundraising period for the Challenge Grant for the purposes of the Challenge Grant. Pledges must be in writing and constitute a legally binding promise to pay. All Pledges require a letter from the donor (for a sample pledge letter, reference Appendix 1) to be submitted with the certification.

Pledges must be realized in cash within the fundraising period.

Defaulting on pledge payments

If a donor defaults in their pledge payment, then the recipient must either 1) enforce collection of the pledges, 2) substitute and report to NEH other eligible gifts, or 3) return to NEH the advanced portion of federal matching funds left unmatched because of the defaulted pledge.

Concerns about defaulting should be discussed with NEH staff at the earliest possible time.

- Use of Challenge Grant Funds as match for other non-federal grants

In rare circumstances, NEH matching funds may also be used to match non-federal foundation Challenge type grant matching requirements (such as from Kresge or Mellon). In order to count toward the foundations matching requirement: 1) the foundations policies must allow for use of the NEH Challenge Grant as a match; and 2) the foundation’s grant must be eligible to count toward the Challenge Grant third-party non-federal gifts requirements.

Other planned gifts must be approved in advance by NEH.

VI. Ineligible Gifts

The following are not eligible Challenge Grant gifts:

- Other federal funds.

- Marketable Securities that have not been sold or converted to cash.

- Real estate not integral to the humanities activities that has not been sold and converted to cash.

- Donated services not directly related to allowable project costs of the Challenge Grant project.

- Gifts derived from the recipient organization itself. This includes shifting internal budgets, selling assets already owned, or reallocating internal funds.

- Gifts or grants derived directly from Challenge Grant recipient institution-specific foundations.

- Tax credits.

- Mortgage payments.

- Interest earned from gifts made for Challenge Grant purposes.

- Other gifts per the Challenge Grant Notice of Funding Opportunity funding restrictions.

VII. Certification of Third-Party Non-federal Gifts

Recipients may certify gifts up to three times a year to release all or part of that year's federal matching funds or simply to fulfill any portion of the total third-party non-federal gifts. At NEH’s discretion, gifts certified in excess of the annual year's requirement will be credited toward the requirements for subsequent years or may be used to release federal funds ahead of schedule.

The Certification of Matching Gifts for NEH Challenge Grants form (Certification) is used to report the eligible third-party non-federal gifts grouped according to the appropriate donor categories. The certification form is broken out by 1) the amounts, if any, of gifts previously certified and the date of the last certification; 2) the amounts of new gifts (and pledges) currently being certified; and, by adding the first two columns together, 3) the current cumulative total of gifts raised (including pledges to be fulfilled) within the fundraising period. Recipients must submit donor documentation with the gift certification for cash gifts from individual donors over $25,000. Supporting documentation for other kinds of gifts must be submitted with the gift certification.

Specific information for submitting the Certification form in eGMS Reach is in Section XI.B. of this document

There are eight donor categories. The categories relate to the donor source, not the type of gift.

- Individuals. The total of eligible gifts donated by individual persons. These individuals may be alumni, trustees, patrons, or others not included in category number six (groups). This includes gifts from donor advised funds, family foundations or identifiable family gift funds held by a community foundation.

- Corporations and businesses. The eligible amounts from businesses, corporations, and company-sponsored or corporate foundations. Note: Many businesses sponsor a program whereby an individual employee's gift to a cultural organization may be complemented by an additional amount from the employer. The company's gift is responsive to the initiative of the employee and can count for matching purposes. The sum of the employee's gift plus match from the employing company should be included under category number one for gifts from individuals

- Private or public foundations. Amounts of gifts from national, state, or community foundations.

- Labor unions or professional or trade associations.

- Non-federal government units, such as state legislative bodies or agencies, county boards, or municipal sources.

- Affiliated groups. The eligible amounts from pooled rather than individual sources or other separate but associated groups. Examples include an alumni association, the class of 1943 as a group gift, membership fees, or "friends groups."

- Special events and benefits. The amount of net proceeds from events such as auctions, raffles, benefit. concerts, or other special fund-raising events.

- Other. The eligible amounts of gifts from miscellaneous sources not classified above. If this amounts to more than ten percent of the matching requirement, please describe the donor sources in the annual performance report.

With the submission of the final certification, the award recipient must attest that all certified pledges have been paid.

Questions regarding certification form and determining the appropriate category of a gift should be directed to your Grant Administrator via eGMS Reach.

VIII. Failure to Meet the Annual Required Third-Party Non-Federal Gift

Organizations that do not meet all or part of their required annual certification of Challenge Grant third-party non-federal gifts may have several options.

A. Extend the Certification Deadline or Rollover to the Next Deadline

If a recipient needs additional time to certify third-party non-federal gifts, a request must be submitted to extend the deadline for certification of required third-party non-federal gifts, or to rollover the certification of required third-party non-federal gifts, to the next annual certification deadline. These extensions are at NEH’s discretion.

Requests to extend or rollover the certification deadline must be submitted by May 31, via eGMS Reach messages.

Requests must include a clear explanation of the delays, a fundraising plan with timeline that addresses how funds will be raised, and how work on the project will be affected and if it can still be completed within the period of performance. NEH will evaluate the request in context to current performance on the award.

B. Forfeiture

If sufficient third-party non-federal gifts are not raised in any given year of the period of performance, the federal matching offer for that year may be forfeited. The forfeiture of some or all federal funds in any given year proportionately reduces the total matching requirement. Forfeiture is at NEH’s discretion. If funds are forfeited, the recipient will need to submit via eGMS Reach messages, a revised budget, and fundraising plan, and if they will be able to complete the project as proposed in the application.

IX. Challenge Grant Management and Record Keeping

A. Recipient Management and Oversight of Challenge Grants

The award recipient of record assumes all programmatic, financial, and legal responsibilities associated with the award and is responsible and accountable to NEH for the administration and expenditure of Challenge Grant funds and matching funds, including subrecipients, and their records are subject to audit. Financial management and administrative requirements are addressed in the GTAC. In addition, recipients with subrecipients must meet the requirements for pass-through entities at 2 CFR § 200.332 and Article III of the GTAC.

Performance during the offer

NEH assesses recipient risk and monitors award performance and compliance throughout the offer and award period. Failure to raise and certify third-party non-federal gifts and meet the conditions of the offer may result in withdrawal of the offer, which is not subject to appeal.

Performance during the award

Issues with performance and compliance may result in additional monitoring and conditions (2 CFR § 200.208), or remedies for non-compliance, including suspension or termination of an award (2 CFR §§ 200.339 – .343). See Article XIII. of the GTAC for additional information.

X. Acknowledgment of support and disclaimer

All materials publicizing or resulting from the Challenge Grant activities must contain an acknowledgment of NEH support. The acknowledgment must include the following statement: "Any views, findings, conclusions, or recommendations expressed in this (publication) (program) (exhibition) (website) do not necessarily represent those of the National Endowment for the Humanities."

If the Challenge Grant project includes renovation or construction activities, the building or site should prominently display a plaque or other permanent sign acknowledging NEH’s support. If NEH’s award contributed to a broader fundraising campaign, the recipient must include NEH in any published list of donors to that campaign related to the NEH-supported project.

When appropriate, the recipient should include the term "humanities" in the names of galleries, classrooms, library rooms, and other named spaces that the recipient built or renovated with award funds. The recipient should consult with its NEH program officer about how to acknowledge NEH in a name or title.

NEH encourages the recipient to find additional ways to acknowledge NEH’s support and bring the award to the public’s attention.

A. Audits and Recordkeeping

All Challenge Grant award records are subject to audit and record retention requirements in the GTAC. See 2 CFR §§ 200.334 – 338 for additional information regarding record retention and access.

Recipients must keep on file documentation showing 1) the value and source of all donations; 2) the donor's awareness, in the case of a restricted gift, that it is being used for the approved Challenge Grant purposes outlined in the proposal; 3) evidence that the gift was received during the fundraising period; and 4) the expenditure of award and matching gift funds on allowable Challenge Grant project costs during the period of performance.

It is important that the award recipient keep clear records of all payments received against eligible certified pledges to prevent duplication of those amounts in subsequent certifications. Documentation for all third-party non-federal gifts, and other evidence of eligibility, such as brochures, posters, recordings, newsletters, and other publicity material, must be retained.

XI. Requesting Payment of Challenge Grant Funds

NEH will issue a notice of action obligating funds for a Challenge Grant award and release grant funds, after third-party non-federal gifts are certified, and offer conditions are met. Recipients may request payment only after the notice of action for the Challenge Grant award has been issued.

Instructions for requesting payment for approved expenditures is available at Payment Requests and Financial Reporting Requirements.

XII. General Reporting Requirements

A. Offer Updates

Once an offer is accepted, the recipient must provide updates every three months (90 days) from the acceptance of the offer date via eGMS Reach messages. The update must include progress made toward meeting the conditions of the offer, fundraising progress, timeline for the project, and any other information on progress or difficulties encountered with implementation.

B. Certification of Matching Gifts for NEH Challenge Grant Form

NEH requires recipients to submit the Certification of Matching Gifts for NEH Challenge Grants form to certify non-federal third-party non-federal gifts by July 31 of each year during the period of performance. Recipients may also certify gifts up to three times a year to release all or part of that year's federal funds or simply to fulfill any portion of the matching requirement.

Additional unscheduled certifications may be submitted using the following instructions:

- On the eGMS Reach Reporting Requirements, under “Additional Unscheduled Reports”, select and add the Challenge Financial report from the “Select a Report to Submit”

- Select the Certification of Gifts/Pledges for Challenge Grants report to fill in and submit.

A final Certification of Matching Gifts for NEH Challenge Grants showing the final cumulative gift amounts, and that all pledges used to match the award have been collected. You must complete the line on the certification form indicating the certified amounts reflect only collected pledges.

C. Federal Financial Reports (SF-425)

Recipients must submit an annual and final Federal Financial Report (SF-425). Instructions are included with the award terms and conditions.

D. Annual Performance Progress Reports (PPR)

Recipients must submit an annual and final performance progress report to NEH. Instructions for the PPR are included with the award terms and conditions.

E. Real Property Status Report (SF-429B)

Projects that involve the purchase, construction or renovation of real property paid for in whole or in part with Challenge Grant funds must be reported annually during the period of performance and the five-year post-award period covered by the NFI. Instructions are included with the award terms and conditions. Additional information on the Real Property Reporting Form SF-429A is in Appendix 2 - Federal Interest in Real Property.

F. Tangible Personal Property Report (SF-428)

Recipients that purchase any tangible personal property (e.g., equipment with a unit cost of $5,000 or more and residual supplies with an aggregate fair market value exceeding $5,000) are required to submit a Tangible Personal Property Form SF-428 within 120 calendar days after the period of performance ends.

Appendix 1 - Sample Donor Letters

Sample Donor Gift Letter.

A donor transmittal letter of some type is required for all restricted gifts of $5,000 or more. The following donor transmittal letters are a model that contributors may use. The reference to the Challenge Grant or its purpose is required for pledges of restricted gifts but is not necessary for pledges of unrestricted gifts.

(Date)

Dear (authorized Organization official):

In support of your National Endowment for the Humanities Challenge Grant [or proposal] (CHA______________), I/we hereby give the sum of $______________ to be used to match and to be expended for the approved purposes of this award. Payment in the form of _______________________ is enclosed.

Sincerely,

(Signature)

Name and Address of Donor

Sample Donor Pledge Letter

All pledges must be in writing. The following sample letter may be used and adapted to circumstances:

(Date)

Dear (authorized Organization official):

In support of your National Endowment for the Humanities Challenge Grant [or proposal] (CHA_____________), I/we hereby pledge the sum of $____________ to be used to match and to be expended for the approved purposes of this award. I/we will make payment on this gift directly to (name of recipient organization) on or before (date of payment), but in no event later than (end date of the period of performance).

Sincerely,

(Signature),

Name and Address of Donor

Appendix 2 - Federal Interest in Real Property

Real property is land, including land improvements, and buildings; it excludes moveable machinery and equipment. The title to real property acquired or improved under an NEH award vests with the recipient. (See 2 CFR §200.311 Real property.)

However, when a recipient uses NEH funds to purchase land or buildings or to construct or renovate a facility, it creates a “federal interest.” Federal interest is a property right which secures the right of the federal awarding agency (NEH) to recover its percentage of funding for the purchase of land or buildings, or for substantial improvements to a facility (construction or major renovations), in the event the property is no longer used for humanities activities by the recipient or upon the disposition of the property. The Federal Government’s interest is intended to protect the purpose for which the federal funds were originally awarded.

Period of Federal Interest

When NEH funds are used to purchase, construct and/or renovate real property, the period of federal interest extends five (5) years from the period of performance end date. During this time, the real property must be used for the intended humanities activities, the owner may not sell, lease, transfer, assign, mortgage, or otherwise convey any interest in the property without prior written approval from the NEH Office of Grant Management. In the event the property is no longer used for humanities activities by the recipient or upon the disposition of the property during the period of federal interest, the recipient must submit a prior approval request through eGMS Reach Change Requests and the SF-429C Real Property Status Report Attachment C (Disposition or Encumbrance Request) through eGMS Reach.

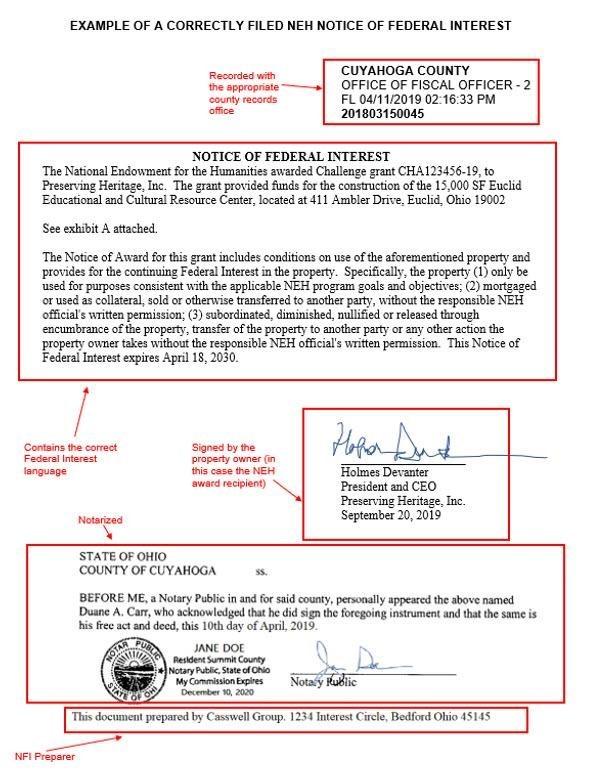

Notice of Federal Interest

When the NEH provides federal funding greater than $500,000 for the purchase of land or buildings, or for new construction, expansion or major renovations, the property owner may be required to attach a lien to the property called a Notice of Federal Interest (NFI) (see 2 CFR §200.316 Property Trust Relationship).

The property owner must record an NFI in the official real property records for the jurisdiction where the property is or will be located. The NFI must be recorded before construction with NEH funds begins and before NEH funds may be drawn down. The NFI will expire five (5) years, from the NEH award period of performance end date. Once the NFI expiration date has passed, no further action is necessary to release the federal interest in the real property.

Annual Reporting

Recipients using NEH funds to purchase land or buildings, or for new construction, expansion or major renovations must submit the SF-429A Real Property Status Report (General Reporting) annually during the period of performance and the five-year period covered by the NFI.

Frequently Asked Questions

Q1: Does federal interest in real property purchased, constructed, or improved with NEH funds exist if a recipient is not required to file a Notice of Federal Interest (NFI)?

A1: Yes. For real property projects funded by the NEH at $500,000 or less, which do not require an NFI, federal interest still exists for a period of five (5) years from the period of performance end date. Recipients must still maintain adequate documentation regarding protection of federal interest. If the building is leased, this includes, but is not limited to: written communications with a lessor related to protecting such interest during the lease period, in accordance with the standard award terms and conditions. The NEH, the NEH Inspector General, the Government Accountability Office, or any of their authorized representatives must be given access to these documents upon request (see 2 CFR § 200.336) ).

Q2: Does NEH take a subordinate position to pre-existing mortgage holders and lenders on potential debt financing for projects?

A2: Yes. NEH's NFI is subordinate to all pre-existing mortgages or obligations recorded against the property. This includes loans and obligations identified by the recipient as sources of financing for the NEH project that are recorded prior to filing the NFI. Pursuant to the NFI, future modifications to existing mortgages, new mortgages, and related types of financing, will require NEH review and prior approval, through eGMS Reach.

Q3: The NEH award required that the facility owner file a Notice of Federal Interest (NFI) against a facility deed. What if the owner wants to secure additional mortgages, lease the facility to an entity that does not provide humanities programming, or sell the facility?

A3: Activities such as new mortgages, selling the facility, or leasing the facility to an entity that does not intend to use it for humanities-related purposes during the period of performance and the five (5) years following the end date, requires prior approval from NEH. The recipient must submit a prior approval request and the SF-429C Real Property Status Report Attachment C (Disposition or Encumbrance Request) through eGMS Reach.

Reviewing federal interest requests takes time and NEH requests patience and cooperation in the process. If the recipient provides detailed requests and supporting documentation up front, this will aid NEH in expediting reviews.

Q4: Are there additional requirements for leased property?

A4: Yes. If an organization applies to NEH to renovate leased property, it must submit a copy of the existing or proposed long-term lease agreement (the lease must extend at least five (5) years from the end of the proposed period of performance), the landlord or lessor’s consent to the renovation, and the landlord or lessor’s agreement to file an NFI (as applicable). The NFI requirements listed above apply to leased property.

Q5: How long does NEH’s federal interest in real property last?

A5: NEH’s federal interest will expire five (5) years after the period of performance end date

Q6: How do I file a Notice of Federal Interest (NFI)?

A6: The process to record an NFI for an NEH-funded project is as follows:

General

Within the United States, except Hawaii, the NFI must be filed in the county or district office in which the facility is located. Often this is the County Court Clerk, Probate Office or the Register of Deeds. In the State of Hawaii, the NFI must be filed with the State Department of Land and Natural Resources, Bureau of Conveyances.

Please understand that local governments may have different formatting requirements. It is important to check with the office before filing, as it may eliminate unnecessary trips.

The county government will provide a copy of the recorded NFI with the county stamp, with a date, and either receipt information, or the final reference number (book and page, file, etc.).

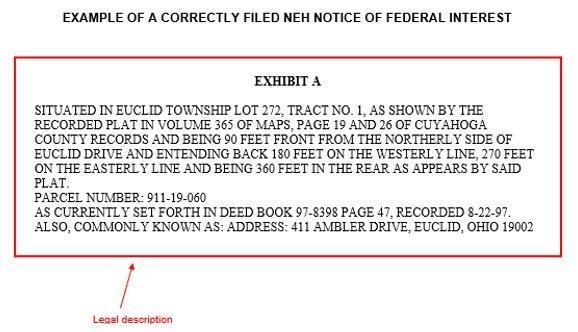

The NFI Document must include:

- The property owners correct legal name and current mailing address.

- The NEH federal award identification number (Challenge Grant award number).

- The description of the project, which should clearly describe the new construction project, purchase of land or buildings, or alteration and renovation.

- The full legal description of the property in the deed. However, Township and Range, or Map, Block, and Lot number will be accepted. A physical address may be included but does not constitute a legal description in itself.

- A statement that the real property: (1) will only be used for purposes consistent with the applicable NEH program goals and objectives; (2) will not be mortgaged or used as collateral, sold or otherwise transferred to another party, without the NEH Office of Grant Management's written permission, and; (3) the federal interest cannot be subordinated, diminished, nullified or released through encumbrance of the property, transfer of the property to another party or any other action the property owner takes prior to the expiration date of the NEH NFI without the NEH Office of Grant Management's written permission.

- The expiration date of the NEH NFI will be five (5) years after the period of performance end date.

- The name and title of the person or company who drafted the notice.

- The signatory of the NFI should be the owner of the property. This indicates the owner’s consent to have a lien filed on the property.

- Review, Sign, Notarize, and File

The draft NFI must first be submitted to the NEH for review and approval of the restrictive language and expiration date,

The NFI must then be notarized and embossed with a notary seal. The NFI must then be recorded with the county government.

A copy of the recorded NFI must be submitted to the NEH.

Q7: Does NEH require a copy of the Notice of Federal Interest (NFI)?

A7: Yes. A copy of the recorded NFI must be submitted to the NEH through eGMS Reach.

Q8: What reporting requirements apply during the period covered by the Notice of Federal Interest (NFI)?

A8: The recipient must submit the SF-429A Real Property Status Report (General Reporting) annually during the period of performance and the five-year period covered by the NFI.